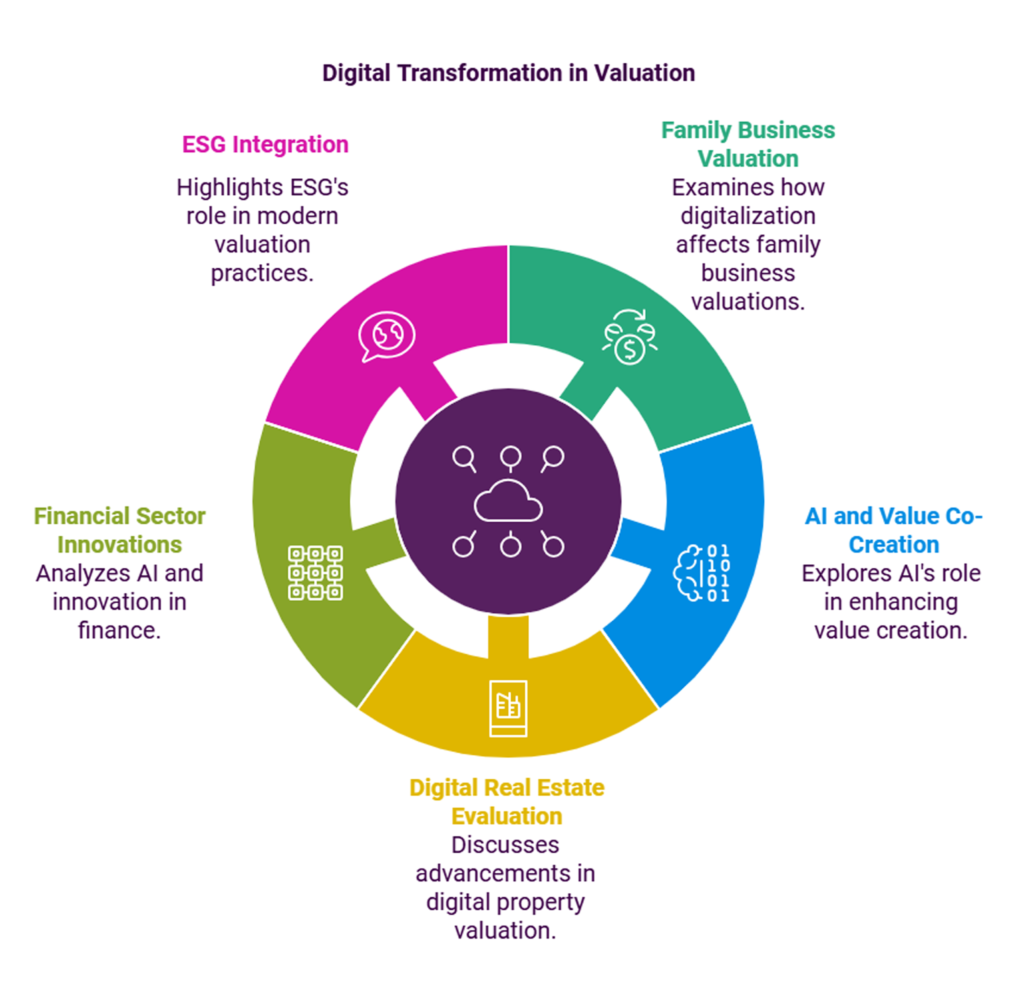

This paper examines the evolving landscape of valuation in the digital era, with a focus on the integration of Environmental, Social, and Governance (ESG) factors. The traditional approach to valuation, primarily based on financial metrics, is being challenged by the rise of intangible assets, technological advancements, and a growing emphasis on sustainability.

Key points discussed include:

1.

The shift from purely financial metrics to a more holistic approach incorporating ESG considerations

2.

The impact of digital transformation on valuation processes, including the challenges of valuing intangible assets

3.

The role of technology in enhancing efficiency and transparency in property valuation

4.

The importance of adapting valuation models to reflect the realities of the digital economy

5.

The potential for ESG integration to positively impact long-term value and investment performance

The paper argues that valuers must adapt to these changes by developing digital ecosystems that emphasize scalability, inclusivity, and sustainability. It concludes that embracing these changes is crucial for accurately capturing an asset’s true value in today’s interconnected world, and that the principles and practices of valuation will continue to evolve alongside the digital economy.

Table of Contents

ToggleIntroduction

In an era where the significance of Environment, Social, and Governance (ESG) considerations is

rapidly ascending, the notion of “value” has transcended old limits in the modern digital landscape.

Traditionally, valuation focused primarily on financial metrics, but today, ESG factors play a crucial

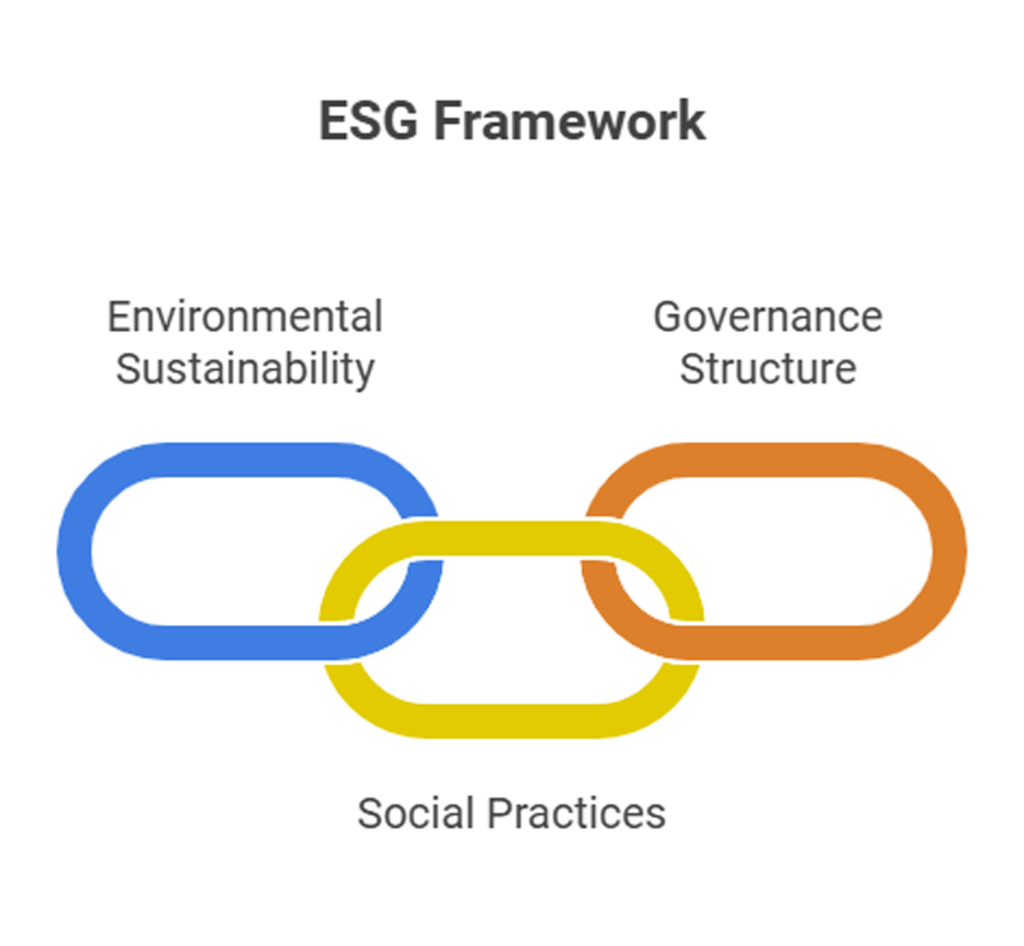

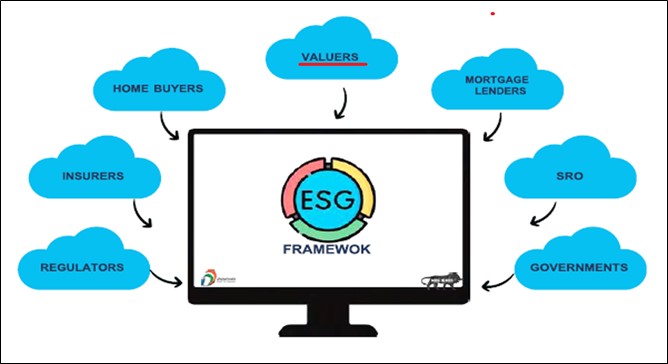

role in the assessment process. ESG stands for Environmental, Social, and Governance as shown in the above Figure. It’s a framework used by companies and investors to evaluate a company’s operations and its impact on society and the environment. ESG criteria cover a range of factors, including a company’s environmental sustainability efforts, its social practices such as labour relations and community engagement, and its governance structure and ethical standards. It’s a shift towards a more responsible way of doing business.

The notion of “value” has widened beyond old limits in the modern digital landscape. Valuing of properties can be an arduous task in recent years, as in the digital age, the perception of valuation has transcended traditional boundaries and entered a dominion where intangibles rule and innovation are at a premium. To address the above problems in quality of asset records/ deals and the net value of a property in the market role, technological developments can and are playing a significant role to bring in transparency in the property registration process by digitalizing and bringing them to an online platform for ease of accessible by Valuers/Creditors (Bankers). So, the Valuers now must consider how an incumbent property contributes to its surrounding environment pollution by using environmentally friendly materials or using green energy etc. or by using rainwater harvesting technics or using solar heating & lightening systems. Also, the Valuers now needs to consider how a property impacts socially through its construction labour management policies or how its governance is related to reducing the negative impact of construction on the environment.

So, the valuation profession is likely to face a period of significant change in coming years in terms of

Documentation Management, the role of Valuers and the benefits they can offer to creditors. Covid has made people pay more attention to how businesses behave ethically and shown that being resilient is more important than being efficient. Moving forward into the ‘New Reality’, there’s a great chance to embed ESG (Environmental, Social, and Governance) not only at the core of organizational purpose and operations but also in real estate functioning. Investors are beginning to recognize that overlooking ESG considerations can pose significant long-term risks to their investments. Also, megatrends such as changing demographics, increasing urbanization, climate change will likely have an impact on the Long-Term Value as well which is as important as the Fair Market Value (FMVs). Furthermore, the International Financial Reporting Standards (IFRS) have emphasized the need for high-quality, transparent, reliable, and comparable reporting on climate and other environmental, social, and governance matters.

Literature Review

Brief Description

The Traditional Approach to Valuation

Traditionally, valuation has been marooned in financial metrics such as revenue, profits, and cash flows. These tangible procedures formed the foundation of evaluating a company’s value, with established methods like discounted cash flow (DCF) analysis being the gold standard. Assets were physical, and their value was relatively straightforward to ascertain with the help of approaches like market, cost, and income.

The Digital Disruption

The advent of the digital age has interrupted the clear-cut approach followed by the traditional valuation methods. Today, a company’s most valuable assets may be its data, algorithms, or user base—none of which fit neatly into the packets of traditional valuation, thus defying the linear logic of old-school valuation.

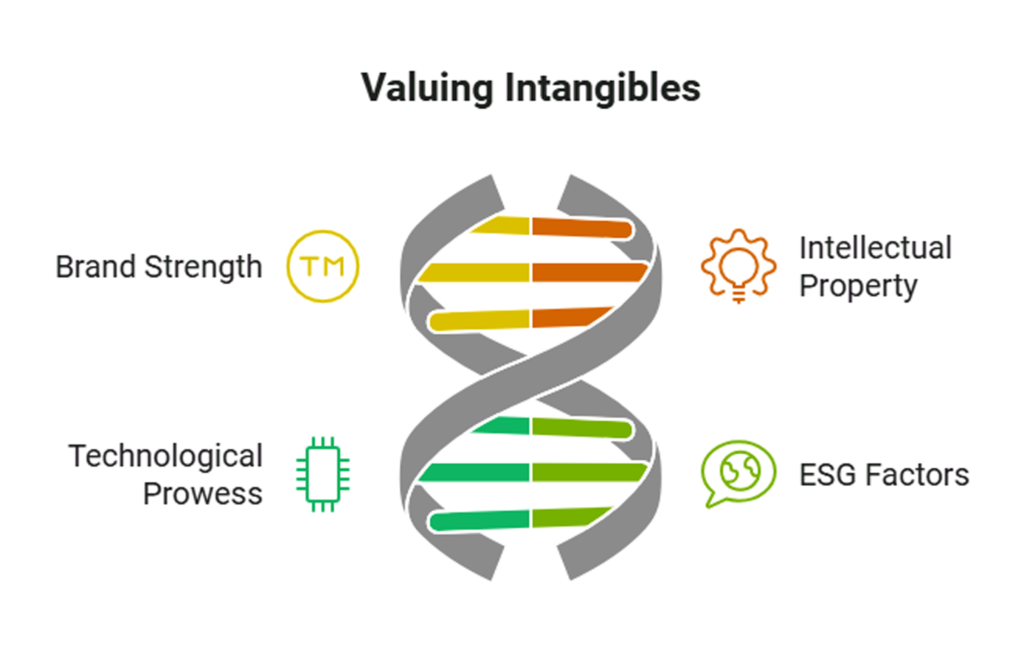

Valuing Intangibles

In the digital economy, intangibles like brand strength, intellectual property, and technological prowess have become vital to a company’s value. Valuing these assets requires a diverse and different set of tools and a forward-looking perspective. Analysts must consider the potential for scalability, the forte of network effects, and the dimensions for innovation. Additionally, ESG factors like environmental sustainability, social responsibility, and governance practices are increasingly influencing valuation processes, pushing analysts to adopt a more holistic approach.

The Future of Valuation thru Digital Transformation

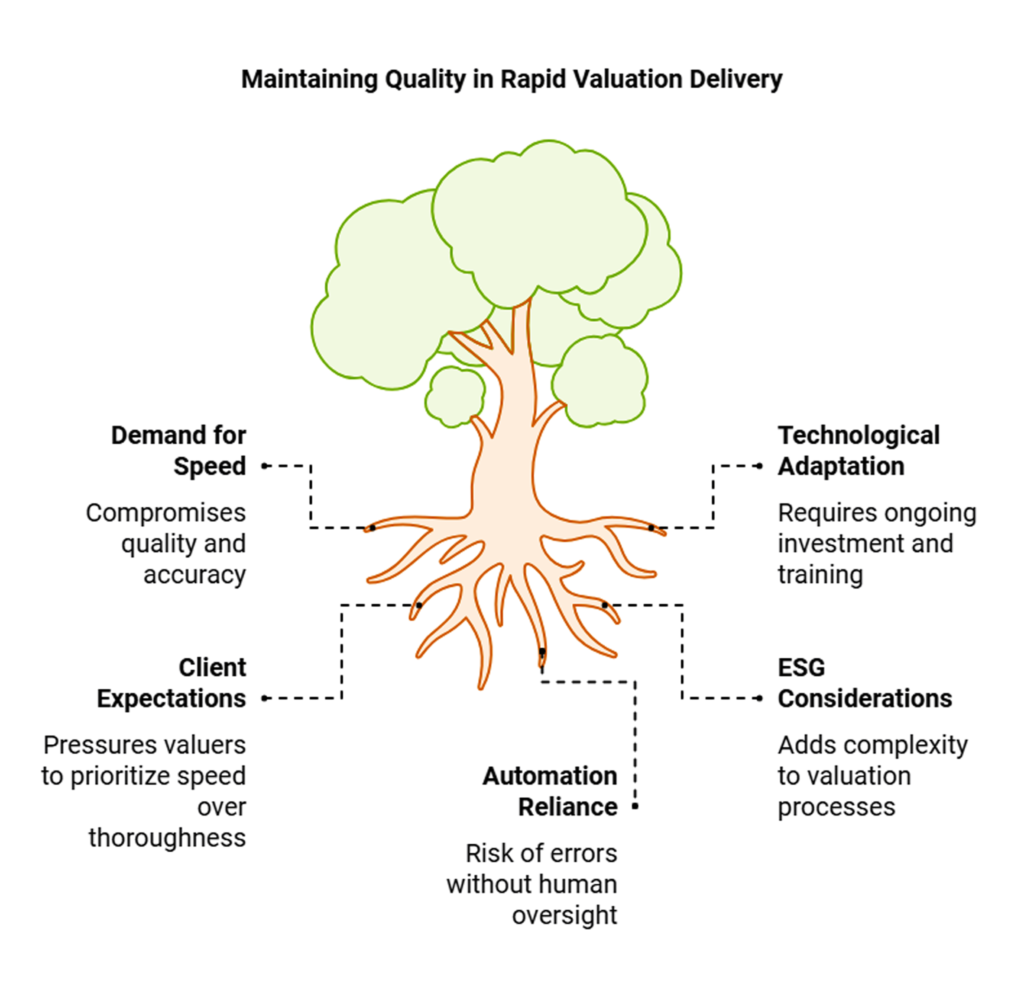

A decade or so ago a month or more was required to produce a valuation report but now valuations are delivered within 4-5 days as creditors demand even shorter deliveries (with just a phone call) to accommodate their business schedules. Valuers who can deliver at that breakneck speed improve their clientele and are likely to receive more business assignments, but the billion-dollar question is how quality, accuracy and timing can be maintained at such a speed. Technology (IT), Automation, Communication and other pillars of digital transformations are likely to qualitatively improve such valuation processes as shown in Fig.2.

However, Valuers who adapt to these technological advancements are likely to thrive, offering improved services to creditors who are beginning to demand assessments that factor in long-term value and

ESG impacts.

Conclusion

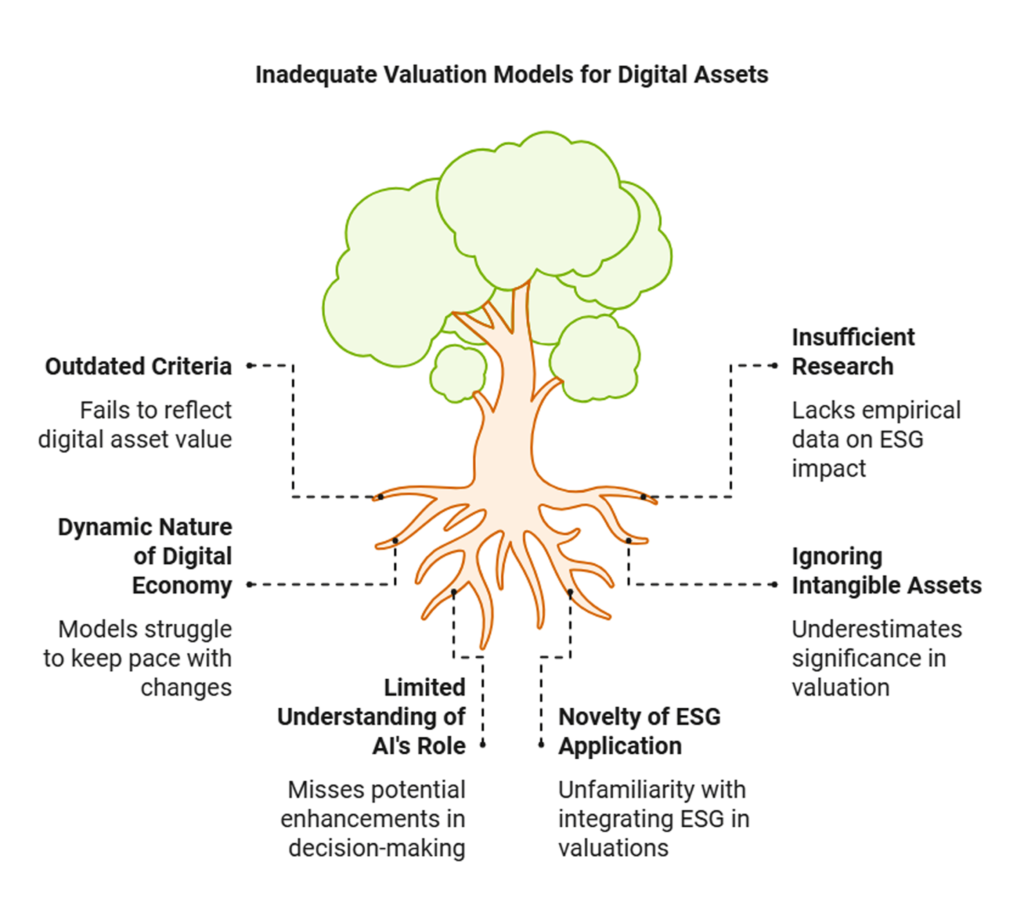

Valuation in the digital age is a complex and dynamic field, demanding a blend of traditional financial analysis and an understanding of digital business models and ESG framework considerations as shown in Fig. As the digital economy evolves, the principles and practices of valuation will continue to shift, reflecting the changing nature of value creation in the 21st century. Embracing these changes will be crucial for accurately capturing an asset’s true value in today’s interconnected world. So, for valuers, this means developing a digital ecosystem that emphasizes scalability, inclusivity, and sustainability. Building a digital ecosystem involves integrating technology to enhance efficiency, accessibility, and transparency in valuations. It requires digital tools to enable streamlined workflows and improved data accuracy.

Lucky Block Casino login sorted easily that’s a great start. Had a quick look around lots of gaming options there. If you’re a crypto user, maybe it’s for you. Think hard before you play though. luckyblockcasinologin

7m.cn.macau is my go-to when I need accurate sports data. Never disappoints. A must have for every serious punter. You can find it here: 7m.cn.macau.